Banco Macro SA - ESG Rating & Company Profile powered by AI

Banco Macro SA - ESG Rating & Company Profile powered by AI

This report of Banco Macro SA incorporates data points from across the web as well as from available filings by Banco Macro SA. This page contains a zero-cost ESG report covering Banco Macro SA. Complete Sustainability analysis of Banco Macro SA are reached by signing up for free.

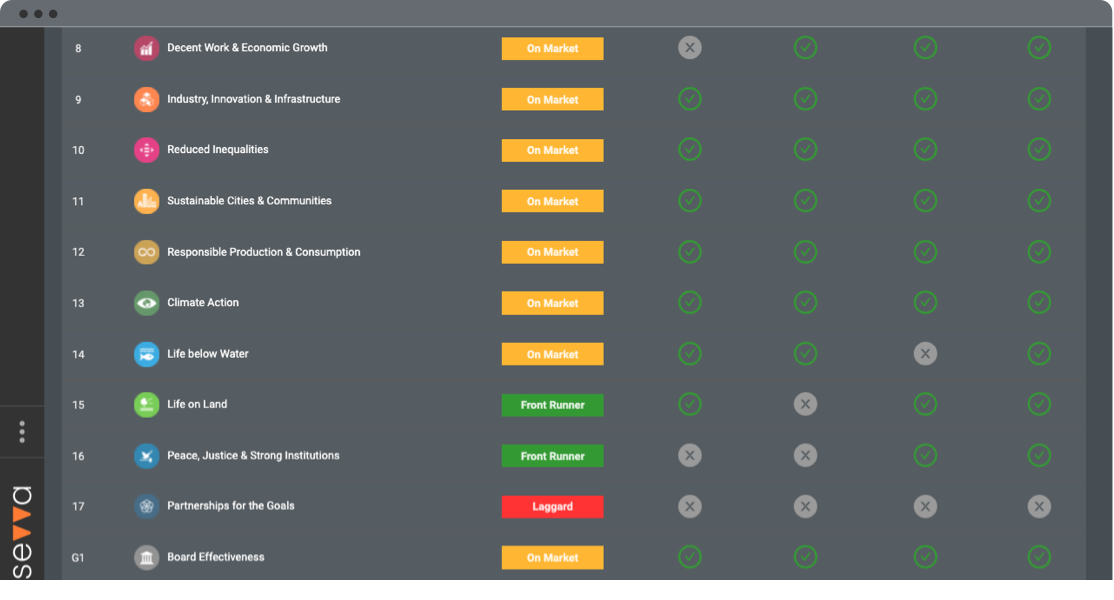

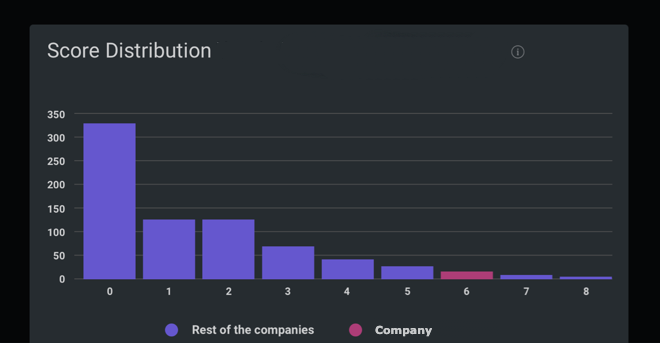

Banco Macro SA in the Banks industry gained a UN SDG ESG Transparency Score of 3.4; made up of an environmental score of 1.3, social score of 2.3 and governance score of 6.7.

3.4

Low ImpactEnvironmental

Social

Governance

Peer Group Comparison

| Rank | Company | SDG Transparency Score ⓘ | Performance |

|---|---|---|---|

| 1 | Landesbank Baden Wuerttemberg | 9.5 | High |

| 2 | UniCredit Bank AG | 9.0 | High |

| ... | ... | ... | |

| 1050 | Societe Generale Ghana Ltd | 3.5 | Medium |

| 1050 | Soneri Bank Ltd | 3.5 | Medium |

| 1063 | Banco Macro SA | 3.4 | Medium |

| 1063 | Bank Al-Habib Ltd | 3.4 | Medium |

| 1063 | Banco Bilbao Vizcaya Argentaria Colombia SA | 3.4 | Medium |

| ... | ... | ... | |

| 1885 | sakartvelos bank'i ss | 0.0 | Low |

| 1885 | AlphaCredit Capital, S.A. de C.V. | 0.0 | Low |

| ... | ... | ... |

Frequently Asked Questions

Does Banco Macro SA have an accelerator or VC vehicle to help deliver innovation?

Does Banco Macro SA disclose current and historical energy intensity?

Does Banco Macro SA report the average age of the workforce?

Does Banco Macro SA reference operational or capital allocation in relation to climate change?

Does Banco Macro SA disclose its ethnicity pay gap?

Does Banco Macro SA disclose cybersecurity risks?

Does Banco Macro SA use carbon offsets or credits exclusively for residual emissions (typically less than ~0.5–5% of total emissions)?

Does Banco Macro SA offer flexible work?

Does Banco Macro SA have a long term incentive (LTI) executive compensation plan based on a measure of return on capital?

Does Banco Macro SA disclose the number of employees in R&D functions?

Does Banco Macro SA plan to change its portfolio composition to lower the emissions intensity of its energy mix (e.g., by shifting from oil to gas, or by adding lower-carbon options like hydrogen, e-fuels, bioenergy, etc.)?

Does Banco Macro SA conduct supply chain audits?

Does Banco Macro SA disclose incidents of non-compliance in relation to the health and safety impacts of products and services?

Is there a statment that there is no plan to expand their cement production? (for example: 'We have no current plans to add additional cement making capacity')

Does Banco Macro SA conduct 360 degree staff reviews?

Does Banco Macro SA disclose the individual responsible for D&I?

Does Banco Macro SA disclose current and historical air emissions?

Is there a statment that there is no plan to expand their coal usage? (for example: 'We have no current plans to add additional coal powered electricity generation')

Is executive remuneration linked to climate performance?

Does the Board describe its role in the oversight of climate-related risks and opportunities?

Does Banco Macro SA disclose current and / or historical scope 2 emissions?

Does Banco Macro SA disclose water use targets?

Does Banco Macro SA have careers partnerships with academic institutions?

Did Banco Macro SA have a product recall in the last two years?

Does Banco Macro SA disclose incidents of discrimination?

Does Banco Macro SA allow for Work Councils/Collective Agreements to be formed?

Has Banco Macro SA issued a profit warning in the past 24 months?

Does Banco Macro SA disclose parental leave metrics?

Does Banco Macro SA disclose climate scenario or pathway analysis?

Does Banco Macro SA disclose current and / or historical scope 1 emissions?

Does Banco Macro SA explicitly state that carbon offsets or credits are separate from its emissions-reduction progress or that they are not counted toward its emissions-reduction targets?

Are Operating Expesnses linked to emissions reduction?

Does Banco Macro SA disclose the pay ratio of women to men?

Does Banco Macro SA support suppliers with sustainability related research and development?

Does Banco Macro SA disclose the number of operations that have been subject to human rights reviews or human rights impact assessments?

Does Banco Macro SA reflect climate-related risks in its financial statements?

Is there a statment that there is no plan to expand their carbon intensite energy assets? (for example: 'We have no current plans to carry out further drilling for oil,')

Is Banco Macro SA involved in embryonic stem cell research?

Does Banco Macro SA disclose GHG and Air Emissions intensity?

Does Banco Macro SA disclose its waste policy?

Does Banco Macro SA report according to TCFD requirements?

Does Banco Macro SA plan to mitigate emissions from future new production assets through measures such as electrifying equipment, carbon capture and storage, repurposing waste gas, methane leak detection and repair, eliminating flaring, etc.?

Does Banco Macro SA disclose its policies for bribery, corruption, whistle-blower, conflict of interest?

Does Banco Macro SA disclose energy use targets?

Does Banco Macro SA disclose its Renewable Energy targets?

Subscription required

Subscription requiredAre emissions metrics verified by STBi?

Subscription required

Subscription requiredDoes Banco Macro SA have a policy relating to cyber security?

Have a different question?

Potential Risks for Banco Macro SA

These potential risks are based on the size, segment and geographies of the company.

Banco Macro S.A. provides various banking products and services to retail and corporate customers in Argentina. It offers various retail banking products and services, such as savings and checking accounts, time deposits, credit and debit cards, consumer finance loans, mortgage loans, automobile loans, overdrafts, credit-related services, home and car insurance coverage, tax collection, utility payments, automated teller machines (ATMs), and money transfers. The company also provides personal loans, document discounts, residential mortgages, overdrafts, pledged loans, and credit card loans to retail customers. In addition, it offers corporate banking products and services, including deposits, lending, check cashing advances and factoring, guaranteed loans, credit lines for financing foreign trade, and cash management services; and trust, payroll, and financial agency services, as well as corporate credit cards and other specialty products; and working capital facilities, credit for investment projects, and leasing and foreign trade transactions. Further, the company provides transaction services, such as cash management, collection services, payments to suppliers, payroll services, foreign exchange transactions, and foreign trade services; information services comprising Datanet and Interpymes services to corporate customers; and Internet and mobile banking services. Additionally, it offers short-term and medium-to-long-term corporate lending products. As of December 31, 2021, it operated through a network of 466 branches, 1,779 ATMs, 955 self-service terminals, and various service points. The company was incorporated in 1966 and is headquartered in Buenos Aires, Argentina.