Braveheart Investment Group PLC - ESG Rating & Company Profile powered by AI

Braveheart Investment Group PLC - ESG Rating & Company Profile powered by AI

This assessment of Braveheart Investment Group PLC leverages information from across the internet as well as from public disclosures by Braveheart Investment Group PLC. Complete ESG assessment of Braveheart Investment Group PLC can be reached by signing up for free. This report of Braveheart Investment Group PLC is prepared by All Street Sevva using proprietary NLP.

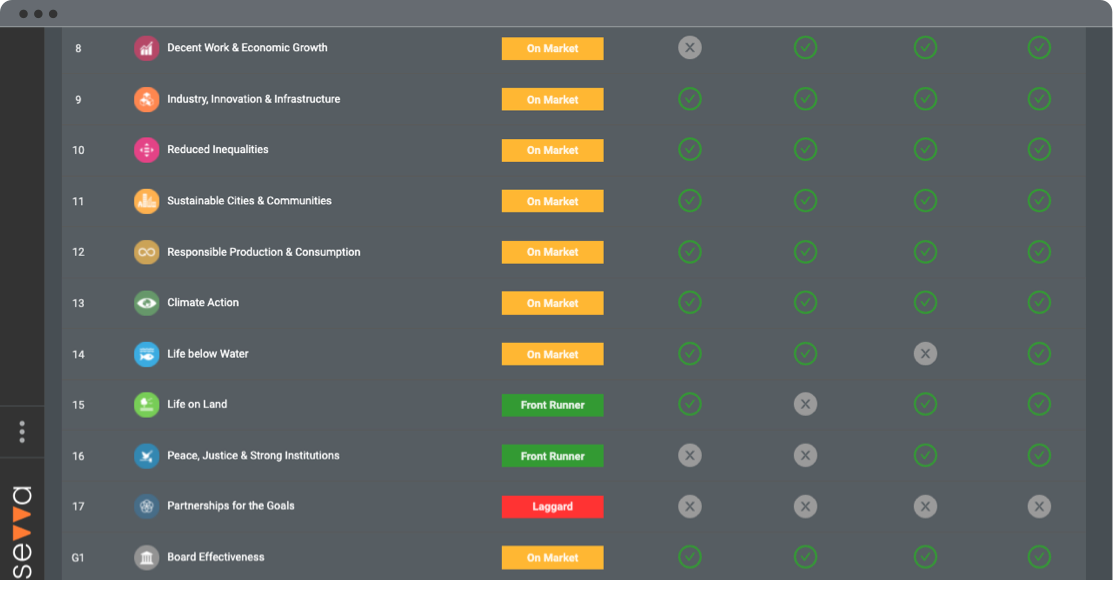

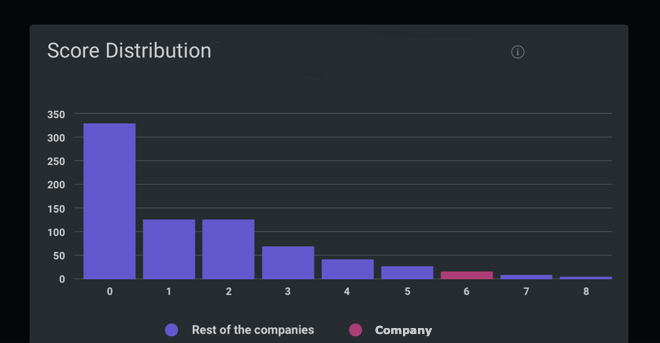

Braveheart Investment Group PLC in the Investment Management & Fund Operators industry gained a UN SDG ESG Transparency Score of 1.8; made up of an environmental score of 0.0, social score of 2.7 and governance score of 2.7.

1.8

Low ImpactEnvironmental

Social

Governance

Peer Group Comparison

| Rank | Company | SDG Transparency Score ⓘ | Performance |

|---|---|---|---|

| 1 | Centuria Capital Ltd | 8.0 | High |

| 1 | Ceylon Guardian Investment Trust PLC | 8.0 | High |

| ... | ... | ... | |

| 475 | Nuveen Investments Inc | 1.9 | Low |

| 475 | Zarclear Holdings Ltd | 1.9 | Low |

| 477 | Braveheart Investment Group PLC | 1.8 | Low |

| 477 | Ceylon Investment PLC | 1.8 | Low |

| 477 | Ares Capital Corp | 1.8 | Low |

| 650 | Zero2ipo Holdings Inc. | 0.0 | Low |

| 650 | advantec Beteiligungskapital AG & Co KGaA | 0.0 | Low |

| ... | ... | ... |

Frequently Asked Questions

Does Braveheart Investment Group PLC have an accelerator or VC vehicle to help deliver innovation?

Does Braveheart Investment Group PLC disclose current and historical energy intensity?

Does Braveheart Investment Group PLC report the average age of the workforce?

Does Braveheart Investment Group PLC reference operational or capital allocation in relation to climate change?

Does Braveheart Investment Group PLC disclose its ethnicity pay gap?

Does Braveheart Investment Group PLC disclose cybersecurity risks?

Does Braveheart Investment Group PLC use carbon offsets or credits exclusively for residual emissions (typically less than ~0.5–5% of total emissions)?

Does Braveheart Investment Group PLC offer flexible work?

Does Braveheart Investment Group PLC have a long term incentive (LTI) executive compensation plan based on a measure of return on capital?

Does Braveheart Investment Group PLC disclose the number of employees in R&D functions?

Does Braveheart Investment Group PLC plan to change its portfolio composition to lower the emissions intensity of its energy mix (e.g., by shifting from oil to gas, or by adding lower-carbon options like hydrogen, e-fuels, bioenergy, etc.)?

Does Braveheart Investment Group PLC conduct supply chain audits?

Does Braveheart Investment Group PLC disclose incidents of non-compliance in relation to the health and safety impacts of products and services?

Is there a statment that there is no plan to expand their cement production? (for example: 'We have no current plans to add additional cement making capacity')

Does Braveheart Investment Group PLC conduct 360 degree staff reviews?

Does Braveheart Investment Group PLC disclose the individual responsible for D&I?

Does Braveheart Investment Group PLC disclose current and historical air emissions?

Is there a statment that there is no plan to expand their coal usage? (for example: 'We have no current plans to add additional coal powered electricity generation')

Is executive remuneration linked to climate performance?

Does the Board describe its role in the oversight of climate-related risks and opportunities?

Does Braveheart Investment Group PLC disclose current and / or historical scope 2 emissions?

Does Braveheart Investment Group PLC disclose water use targets?

Does Braveheart Investment Group PLC have careers partnerships with academic institutions?

Did Braveheart Investment Group PLC have a product recall in the last two years?

Does Braveheart Investment Group PLC disclose incidents of discrimination?

Does Braveheart Investment Group PLC allow for Work Councils/Collective Agreements to be formed?

Has Braveheart Investment Group PLC issued a profit warning in the past 24 months?

Does Braveheart Investment Group PLC disclose parental leave metrics?

Does Braveheart Investment Group PLC disclose climate scenario or pathway analysis?

Does Braveheart Investment Group PLC disclose current and / or historical scope 1 emissions?

Does Braveheart Investment Group PLC explicitly state that carbon offsets or credits are separate from its emissions-reduction progress or that they are not counted toward its emissions-reduction targets?

Are Operating Expesnses linked to emissions reduction?

Does Braveheart Investment Group PLC disclose the pay ratio of women to men?

Does Braveheart Investment Group PLC support suppliers with sustainability related research and development?

Does Braveheart Investment Group PLC disclose the number of operations that have been subject to human rights reviews or human rights impact assessments?

Does Braveheart Investment Group PLC reflect climate-related risks in its financial statements?

Is there a statment that there is no plan to expand their carbon intensite energy assets? (for example: 'We have no current plans to carry out further drilling for oil,')

Is Braveheart Investment Group PLC involved in embryonic stem cell research?

Does Braveheart Investment Group PLC disclose GHG and Air Emissions intensity?

Does Braveheart Investment Group PLC disclose its waste policy?

Does Braveheart Investment Group PLC report according to TCFD requirements?

Does Braveheart Investment Group PLC plan to mitigate emissions from future new production assets through measures such as electrifying equipment, carbon capture and storage, repurposing waste gas, methane leak detection and repair, eliminating flaring, etc.?

Does Braveheart Investment Group PLC disclose its policies for bribery, corruption, whistle-blower, conflict of interest?

Does Braveheart Investment Group PLC disclose energy use targets?

Does Braveheart Investment Group PLC disclose its Renewable Energy targets?

Subscription required

Subscription requiredAre emissions metrics verified by STBi?

Subscription required

Subscription requiredDoes Braveheart Investment Group PLC have a policy relating to cyber security?

Have a different question?

Potential Risks for Braveheart Investment Group PLC

These potential risks are based on the size, segment and geographies of the company.

Braveheart Investment Group plc is a private equity and venture capital firm specializing in seed, start-up, early stage, growth stage, expansion stage, growth capital, turnaround, restructuring, management buy-out, management buy-in, spinout, loan and mezzanine funding, and follow-on and secondary purchase stage investments in unquoted emerging companies. It also provides equity & equity-linked investments in growth, small and medium sized enterprises and B2B. The firm does not invest in any project involved in shipbuilding, coal, or steel sector; is involved in dealing in land, commodities, futures or the instruments of any holding company that are traded on a stock exchange, wholesale trade or retailing; former ECSC sectors; agriculture, aquaculture, fisheries, synthetic fibre, production; railway, road haulage, maritime and aviation transport companies; banking, insurance, money lending, debt factoring, hire purchase financing and other financial activities; leasing or letting assets on hire; providing legal or accountancy services; operating or managing hotel or nursing or residential care homes, film production, hotels, and property (although this may be considered as part of a wider transaction). It primarily invests in technology, manufacturing, food and drink, chemical, biosciences, healthcare, creative and digital industries, information and communications technology/software/telecoms/media, environmental technologies, financial and business services, sports sector, bio-medical, engineering, materials, information sciences, and computing technology sectors in the higher education sector, retail, and service industry based businesses. It also invests in debt. It typically invests in small and medium enterprises based in United Kingdom and Ireland. It prefers to invest in Yorkshire and Humber region. The firm seeks to invest between £0.010 million ($0.012 million) and £10 million ($15.71 million) in its portfolio companies but will also participate in larger syndicates where sums raised might be £5 milli