Chino Commercial Bancorp - ESG Rating & Company Profile powered by AI

Chino Commercial Bancorp - ESG Rating & Company Profile powered by AI

This report of Chino Commercial Bancorp uses data from across the internet as well as from available disclosures by Chino Commercial Bancorp. If you are employed by Chino Commercial Bancorp and you would like to use your ESG aseessment, please contact us. This dashboard includes a Q&A table for Chino Commercial Bancorp.

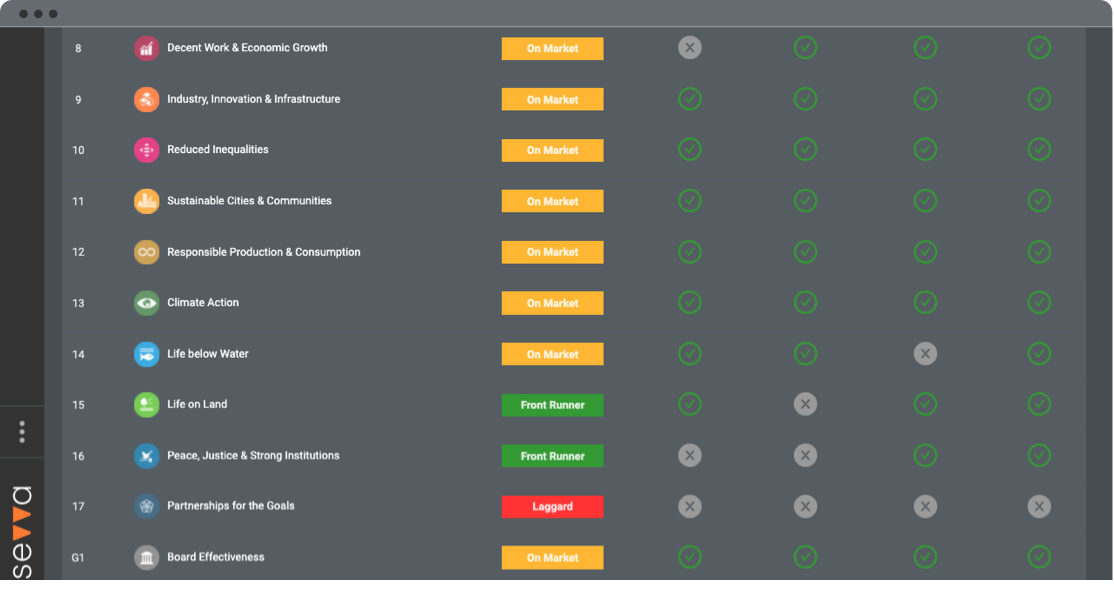

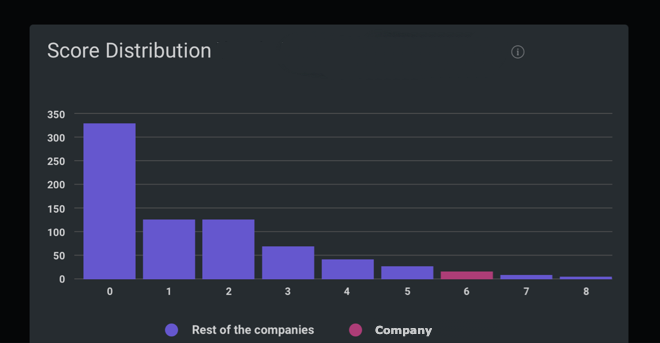

Chino Commercial Bancorp in the Banks industry gained a UN SDG ESG Transparency Score of 0.9; made up of an environmental score of 0.0, social score of 0.0 and governance score of 2.7.

0.9

Low ImpactEnvironmental

Social

Governance

Peer Group Comparison

| Rank | Company | SDG Transparency Score ⓘ | Performance |

|---|---|---|---|

| 1 | Landesbank Baden Wuerttemberg | 9.5 | High |

| 2 | UniCredit Bank AG | 9.0 | High |

| ... | ... | ... | |

| 1680 | First Merchants Corp | 1.0 | Low |

| 1680 | United Community Banks Inc | 1.0 | Low |

| 1684 | Chino Commercial Bancorp | 0.9 | Low |

| 1684 | CIB Marine Bancshares Inc | 0.9 | Low |

| 1684 | Cardinal Bankshares Corp | 0.9 | Low |

| 1885 | sakartvelos bank'i ss | 0.0 | Low |

| 1885 | AlphaCredit Capital, S.A. de C.V. | 0.0 | Low |

| ... | ... | ... |

Frequently Asked Questions

Does Chino Commercial Bancorp have an accelerator or VC vehicle to help deliver innovation?

Does Chino Commercial Bancorp disclose current and historical energy intensity?

Does Chino Commercial Bancorp report the average age of the workforce?

Does Chino Commercial Bancorp reference operational or capital allocation in relation to climate change?

Does Chino Commercial Bancorp disclose its ethnicity pay gap?

Does Chino Commercial Bancorp disclose cybersecurity risks?

Does Chino Commercial Bancorp use carbon offsets or credits exclusively for residual emissions (typically less than ~0.5–5% of total emissions)?

Does Chino Commercial Bancorp offer flexible work?

Does Chino Commercial Bancorp have a long term incentive (LTI) executive compensation plan based on a measure of return on capital?

Does Chino Commercial Bancorp disclose the number of employees in R&D functions?

Does Chino Commercial Bancorp plan to change its portfolio composition to lower the emissions intensity of its energy mix (e.g., by shifting from oil to gas, or by adding lower-carbon options like hydrogen, e-fuels, bioenergy, etc.)?

Does Chino Commercial Bancorp conduct supply chain audits?

Does Chino Commercial Bancorp disclose incidents of non-compliance in relation to the health and safety impacts of products and services?

Is there a statment that there is no plan to expand their cement production? (for example: 'We have no current plans to add additional cement making capacity')

Does Chino Commercial Bancorp conduct 360 degree staff reviews?

Does Chino Commercial Bancorp disclose the individual responsible for D&I?

Does Chino Commercial Bancorp disclose current and historical air emissions?

Is there a statment that there is no plan to expand their coal usage? (for example: 'We have no current plans to add additional coal powered electricity generation')

Is executive remuneration linked to climate performance?

Does the Board describe its role in the oversight of climate-related risks and opportunities?

Does Chino Commercial Bancorp disclose current and / or historical scope 2 emissions?

Does Chino Commercial Bancorp disclose water use targets?

Does Chino Commercial Bancorp have careers partnerships with academic institutions?

Did Chino Commercial Bancorp have a product recall in the last two years?

Does Chino Commercial Bancorp disclose incidents of discrimination?

Does Chino Commercial Bancorp allow for Work Councils/Collective Agreements to be formed?

Has Chino Commercial Bancorp issued a profit warning in the past 24 months?

Does Chino Commercial Bancorp disclose parental leave metrics?

Does Chino Commercial Bancorp disclose climate scenario or pathway analysis?

Does Chino Commercial Bancorp disclose current and / or historical scope 1 emissions?

Does Chino Commercial Bancorp explicitly state that carbon offsets or credits are separate from its emissions-reduction progress or that they are not counted toward its emissions-reduction targets?

Are Operating Expesnses linked to emissions reduction?

Does Chino Commercial Bancorp disclose the pay ratio of women to men?

Does Chino Commercial Bancorp support suppliers with sustainability related research and development?

Does Chino Commercial Bancorp disclose the number of operations that have been subject to human rights reviews or human rights impact assessments?

Does Chino Commercial Bancorp reflect climate-related risks in its financial statements?

Is there a statment that there is no plan to expand their carbon intensite energy assets? (for example: 'We have no current plans to carry out further drilling for oil,')

Is Chino Commercial Bancorp involved in embryonic stem cell research?

Does Chino Commercial Bancorp disclose GHG and Air Emissions intensity?

Does Chino Commercial Bancorp disclose its waste policy?

Does Chino Commercial Bancorp report according to TCFD requirements?

Does Chino Commercial Bancorp plan to mitigate emissions from future new production assets through measures such as electrifying equipment, carbon capture and storage, repurposing waste gas, methane leak detection and repair, eliminating flaring, etc.?

Does Chino Commercial Bancorp disclose its policies for bribery, corruption, whistle-blower, conflict of interest?

Does Chino Commercial Bancorp disclose energy use targets?

Does Chino Commercial Bancorp disclose its Renewable Energy targets?

Subscription required

Subscription requiredAre emissions metrics verified by STBi?

Subscription required

Subscription requiredDoes Chino Commercial Bancorp have a policy relating to cyber security?

Have a different question?

Potential Risks for Chino Commercial Bancorp

These potential risks are based on the size, segment and geographies of the company.

Chino Commercial Bancorp operates as the bank holding company for Chino Commercial Bank, N.A. that provides commercial banking services to individuals and small businesses primarily in the Inland Empire region of Southern California. The company's deposit products include non-interest bearing deposits, money market accounts, checking and savings accounts, certificates of deposit, and individual retirement accounts. It also provides commercial loan products, such as lines of credit, letters of credit, term loans and equipment loans, commercial real estate loans, accounts receivable financing, factoring, equipment leasing, and other working capital financing; auto, home equity and home improvement lines of credit, and personal lines of credit; and real estate loan products comprising construction loans, lot loans, residential real estate brokerage, commercial real estate conduit sales, mini-perm commercial real estates, and home mortgages. In addition, the company offers credit and debit card, cashier's checks, courier, direct deposit, remote deposit capture, e-statement, electronic tax payment, night depository, notary, safe deposit box, savings bond, wire transfer, stop payment, and cash management, as well as online, telephone, and mobile banking services. It operates full-service branches in Chino, Ontario, Rancho Cucamonga, and Upland, California. Chino Commercial Bancorp was founded in 1999 and is headquartered in Chino, California.