SmartCentres Real Estate Investment Trust - ESG Rating & Company Profile powered by AI

SmartCentres Real Estate Investment Trust - ESG Rating & Company Profile powered by AI

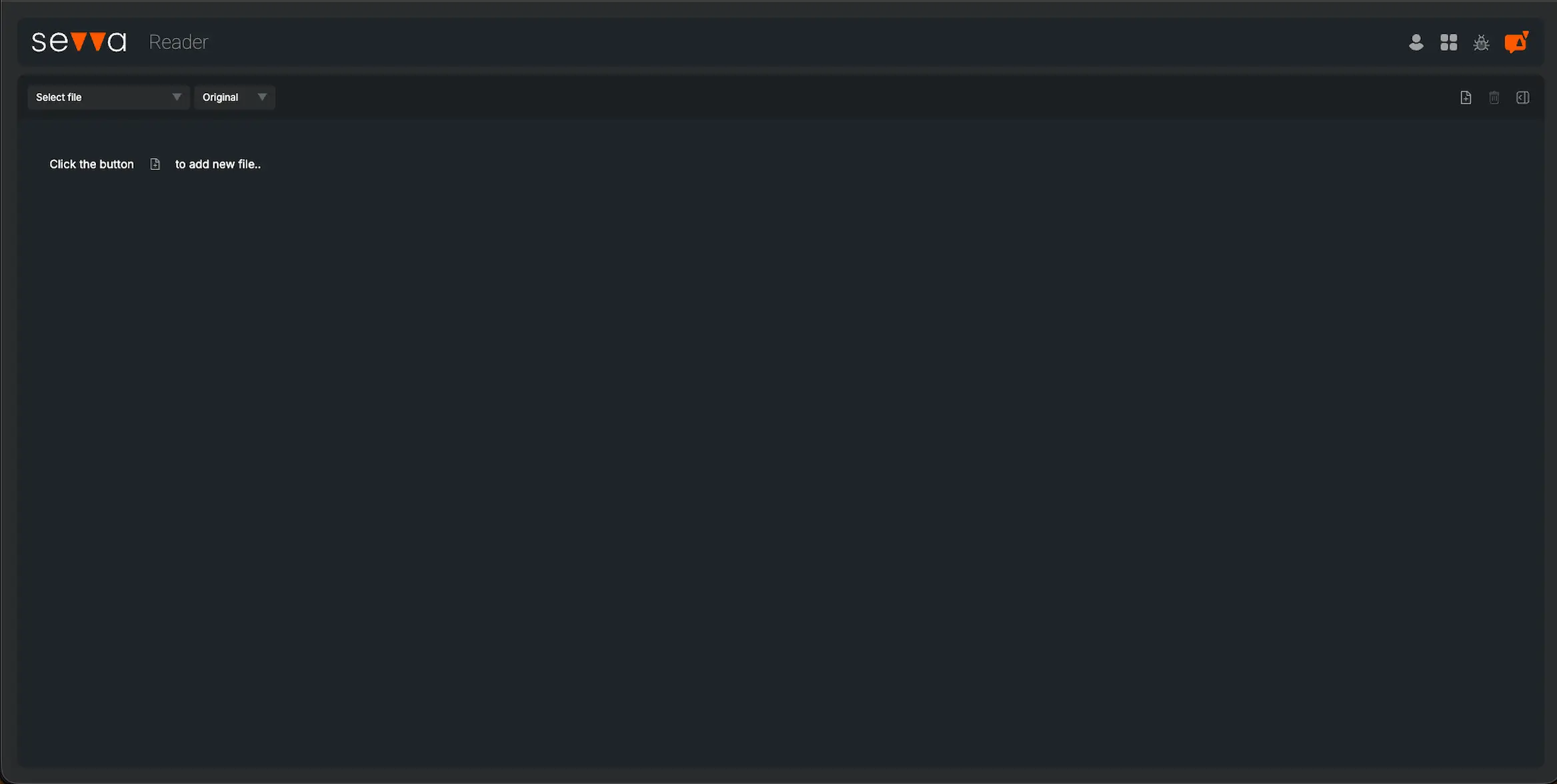

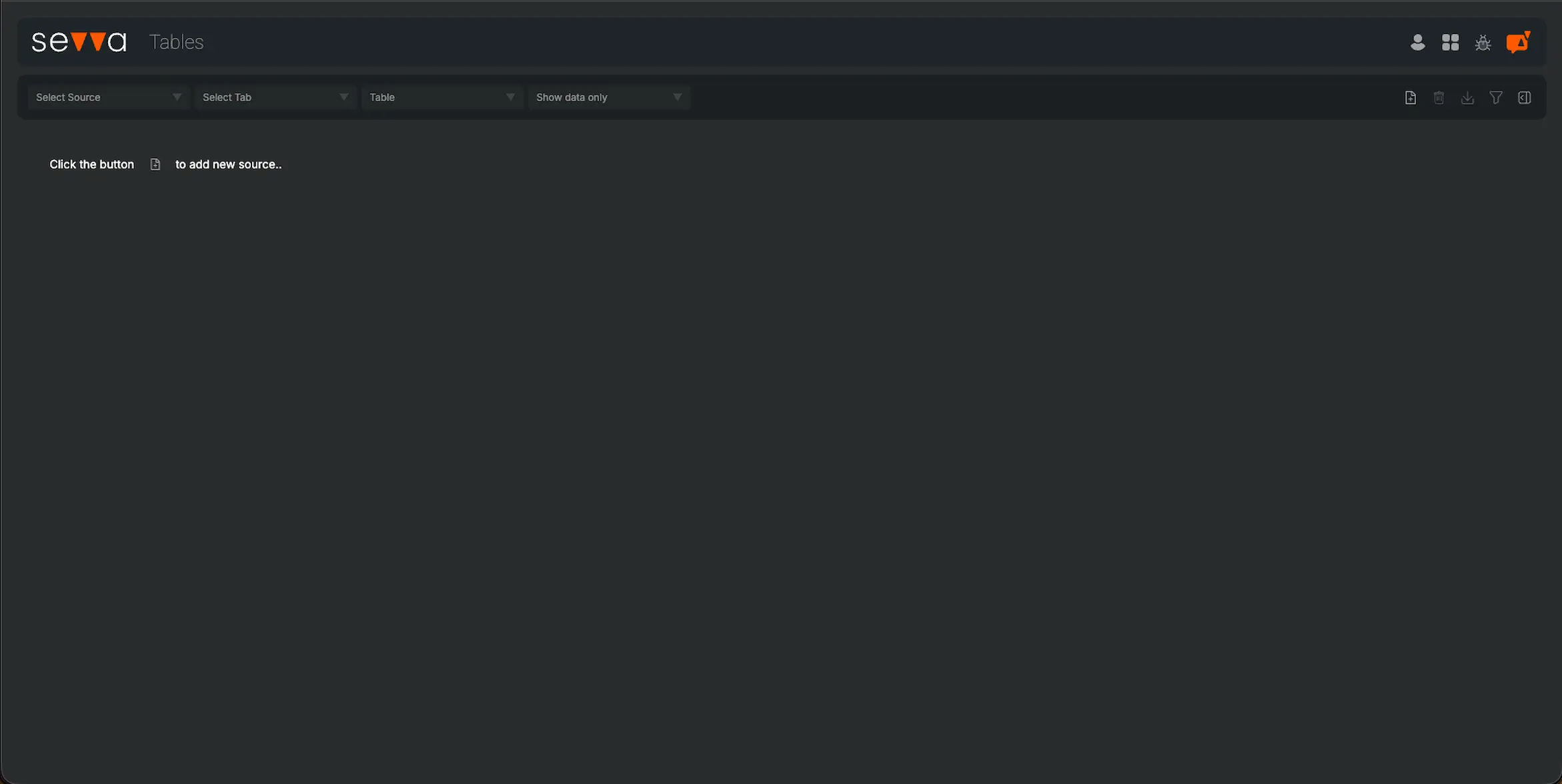

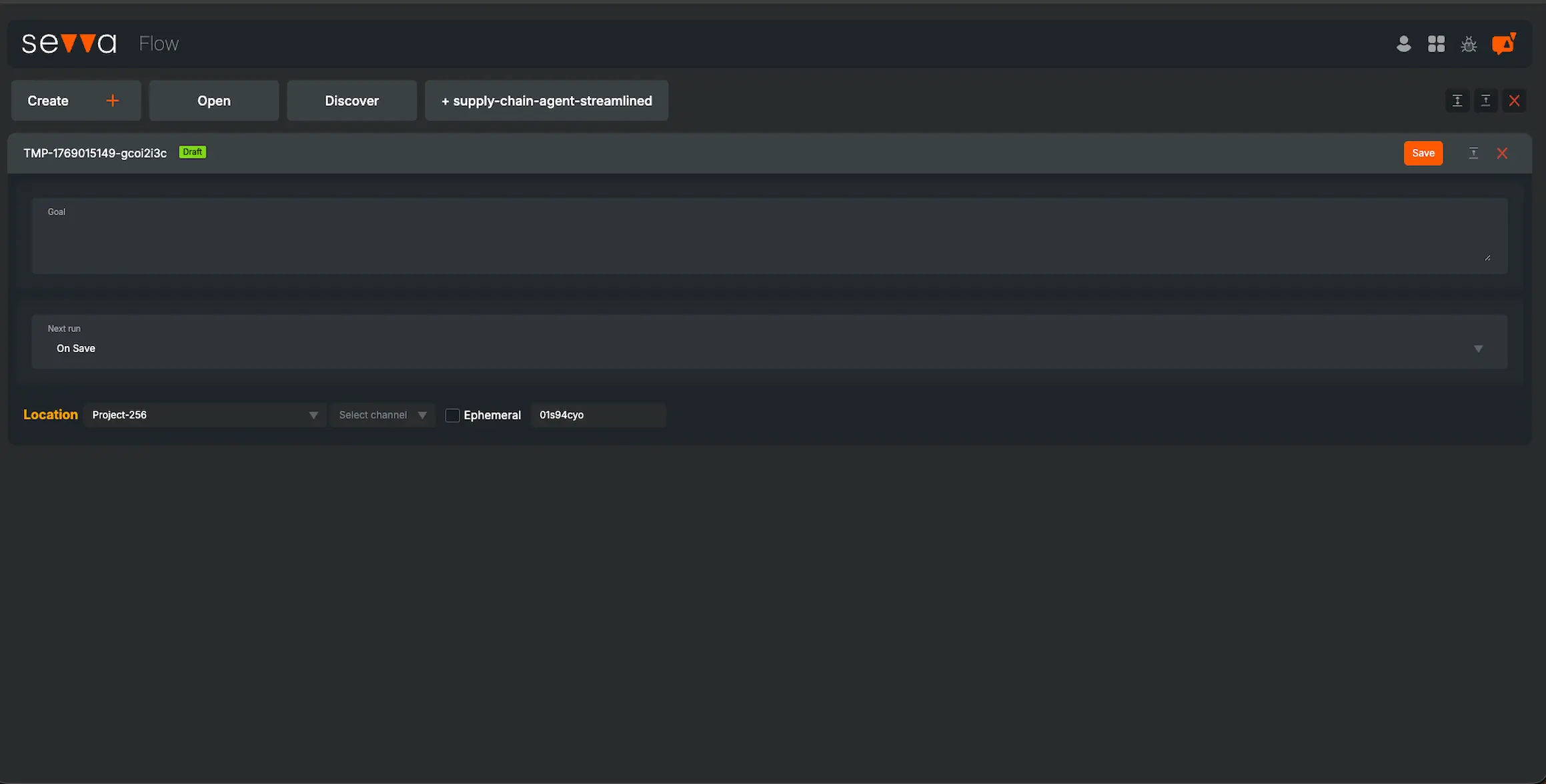

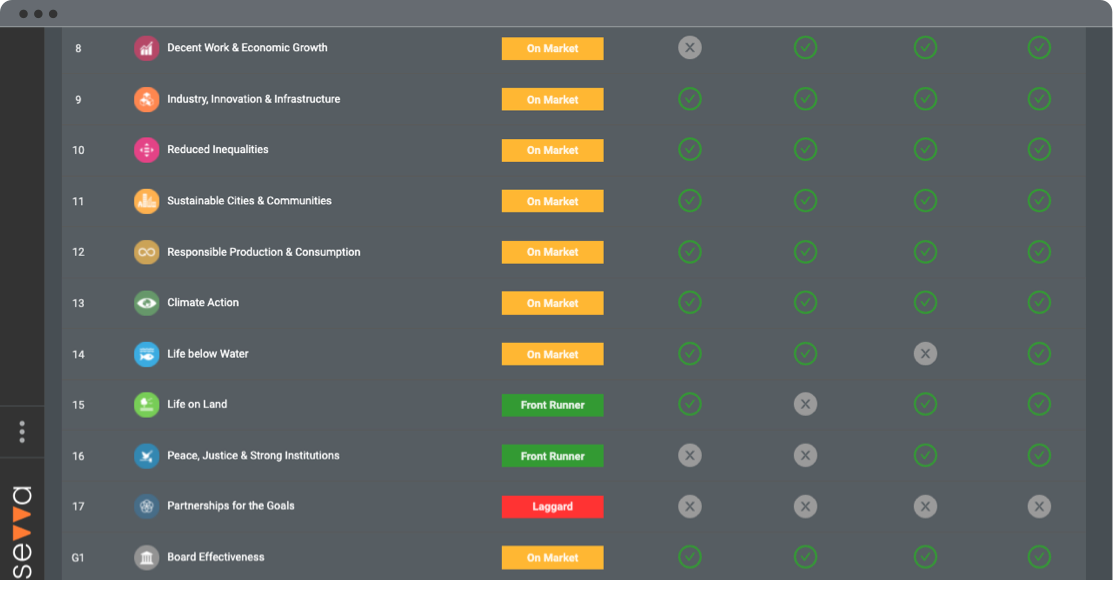

Complete Sustainability analysis of SmartCentres Real Estate Investment Trust are reached by registering for free. This ESG score includes 17 United Nations SDGs including: 'Clean Water & Sanitation', 'Reduced Inequalities' and 'Life below Water'. Alternative corporations in the rating industry group for SmartCentres Real Estate Investment Trust are displayed below.

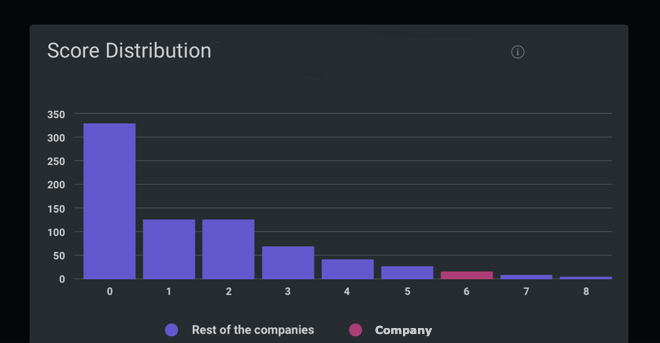

SmartCentres Real Estate Investment Trust in the Commercial REITs industry gained a UN SDG ESG Transparency Score of 3.6; made up of an environmental score of 3.4, social score of 4.6 and governance score of 2.7.

3.6

Low ImpactEnvironmental

Social

Governance

Peer Group Comparison

| Rank | Company | SDG Transparency Score ⓘ | Performance |

|---|---|---|---|

| 1 | CapitaLand Malaysia Mall Trust | 8.0 | High |

| 1 | Akfen Gayrimenkul Yatirim Ortakligi AS | 8.0 | High |

| ... | ... | ... | |

| 196 | One REIT Inc | 3.7 | Medium |

| 196 | Spirit Realty Capital Inc | 3.7 | Medium |

| 200 | SmartCentres Real Estate Investment Trust | 3.6 | Medium |

| 200 | Brandywine Realty Trust | 3.6 | Medium |

| 200 | Alony Hetz Properties and Investments Ltd | 3.6 | Medium |

| ... | ... | ... | |

| 327 | Winthrop Realty Trust | 0.0 | Low |

| 327 | Zaragoza Properties SOCIMI SA | 0.0 | Low |

| ... | ... | ... |

Frequently Asked Questions

Does SmartCentres Real Estate Investment Trust have an accelerator or VC vehicle to help deliver innovation?

Does SmartCentres Real Estate Investment Trust disclose current and historical energy intensity?

Does SmartCentres Real Estate Investment Trust report the average age of the workforce?

Does SmartCentres Real Estate Investment Trust reference operational or capital allocation in relation to climate change?

Does SmartCentres Real Estate Investment Trust disclose its ethnicity pay gap?

Does SmartCentres Real Estate Investment Trust disclose cybersecurity risks?

Does SmartCentres Real Estate Investment Trust use carbon offsets or credits exclusively for residual emissions (typically less than ~0.5–5% of total emissions)?

Does SmartCentres Real Estate Investment Trust offer flexible work?

Does SmartCentres Real Estate Investment Trust have a long term incentive (LTI) executive compensation plan based on a measure of return on capital?

Does SmartCentres Real Estate Investment Trust disclose the number of employees in R&D functions?

Does SmartCentres Real Estate Investment Trust plan to change its portfolio composition to lower the emissions intensity of its energy mix (e.g., by shifting from oil to gas, or by adding lower-carbon options like hydrogen, e-fuels, bioenergy, etc.)?

Does SmartCentres Real Estate Investment Trust conduct supply chain audits?

Does SmartCentres Real Estate Investment Trust disclose incidents of non-compliance in relation to the health and safety impacts of products and services?

Is there a statment that there is no plan to expand their cement production? (for example: 'We have no current plans to add additional cement making capacity')

Does SmartCentres Real Estate Investment Trust conduct 360 degree staff reviews?

Does SmartCentres Real Estate Investment Trust disclose the individual responsible for D&I?

Does SmartCentres Real Estate Investment Trust disclose current and historical air emissions?

Is there a statment that there is no plan to expand their coal usage? (for example: 'We have no current plans to add additional coal powered electricity generation')

Is executive remuneration linked to climate performance?

Does the Board describe its role in the oversight of climate-related risks and opportunities?

Does SmartCentres Real Estate Investment Trust disclose current and / or historical scope 2 emissions?

Does SmartCentres Real Estate Investment Trust disclose water use targets?

Does SmartCentres Real Estate Investment Trust have careers partnerships with academic institutions?

Did SmartCentres Real Estate Investment Trust have a product recall in the last two years?

Does SmartCentres Real Estate Investment Trust disclose incidents of discrimination?

Does SmartCentres Real Estate Investment Trust allow for Work Councils/Collective Agreements to be formed?

Has SmartCentres Real Estate Investment Trust issued a profit warning in the past 24 months?

Does SmartCentres Real Estate Investment Trust disclose parental leave metrics?

Does SmartCentres Real Estate Investment Trust disclose climate scenario or pathway analysis?

Does SmartCentres Real Estate Investment Trust disclose current and / or historical scope 1 emissions?

Does SmartCentres Real Estate Investment Trust explicitly state that carbon offsets or credits are separate from its emissions-reduction progress or that they are not counted toward its emissions-reduction targets?

Are Operating Expesnses linked to emissions reduction?

Does SmartCentres Real Estate Investment Trust disclose the pay ratio of women to men?

Does SmartCentres Real Estate Investment Trust support suppliers with sustainability related research and development?

Does SmartCentres Real Estate Investment Trust disclose the number of operations that have been subject to human rights reviews or human rights impact assessments?

Does SmartCentres Real Estate Investment Trust reflect climate-related risks in its financial statements?

Is there a statment that there is no plan to expand their carbon intensite energy assets? (for example: 'We have no current plans to carry out further drilling for oil,')

Is SmartCentres Real Estate Investment Trust involved in embryonic stem cell research?

Does SmartCentres Real Estate Investment Trust disclose GHG and Air Emissions intensity?

Does SmartCentres Real Estate Investment Trust disclose its waste policy?

Does SmartCentres Real Estate Investment Trust report according to TCFD requirements?

Does SmartCentres Real Estate Investment Trust plan to mitigate emissions from future new production assets through measures such as electrifying equipment, carbon capture and storage, repurposing waste gas, methane leak detection and repair, eliminating flaring, etc.?

Does SmartCentres Real Estate Investment Trust disclose its policies for bribery, corruption, whistle-blower, conflict of interest?

Does SmartCentres Real Estate Investment Trust disclose energy use targets?

Does SmartCentres Real Estate Investment Trust disclose its Renewable Energy targets?

Subscription required

Subscription requiredAre emissions metrics verified by STBi?

Subscription required

Subscription requiredDoes SmartCentres Real Estate Investment Trust have a policy relating to cyber security?

Have a different question?

Potential Risks for SmartCentres Real Estate Investment Trust

These potential risks are based on the size, segment and geographies of the company.

SmartCentres Real Estate Investment Trust is one of Canada's largest fully integrated REITs, with a best-in-class portfolio featuring 166 strategically located properties in communities across the country. SmartCentres has approximately $10.4 billion in assets and owns 33.8 million square feet of income producing value-oriented retail space with 97.4% occupancy, on 3,500 acres of owned land across Canada. SmartCentres continues to focus on enhancing the lives of Canadians by planning and developing complete, connected, mixed-use communities on its existing retail properties. A publicly announced $11.9 billion intensification program ($5.4 billion at SmartCentres' share) represents the REIT's current major development focus on which construction is expected to commence within the next five years. This intensification program consists of rental apartments, condos, seniors' residences and hotels, to be developed under the SmartLiving banner, and retail, office, and storage facilities, to be developed under the SmartCentres banner. SmartCentres' intensification program is expected to produce an additional 59.3 million square feet (27.9 million square feet at SmartCentres' share) of space, 27.1 million square feet (12.3 million square feet at SmartCentres' share) of which has or will commence construction within next five years. From shopping centres to city centres, SmartCentres is uniquely positioned to reshape the Canadian urban and urban-suburban landscape. Included in this intensification program is the Trust's share of SmartVMC which, when completed, is expected to include approximately 11.0 million square feet of mixed-use space in Vaughan, Ontario. Construction of the first five sold-out phases of Transit City Condominiums that represent 2,789 residential units continues to progress. Final closings of the first two phases of Transit City Condominiums began ahead of budget and ahead of schedule in August 2020 and as at September 30, 2020, 766 units (representing approximately 70% of all 1,110 units in the first