Rosecliff Acquisition Corp I - ESG Rating & Company Profile powered by AI

Rosecliff Acquisition Corp I - ESG Rating & Company Profile powered by AI

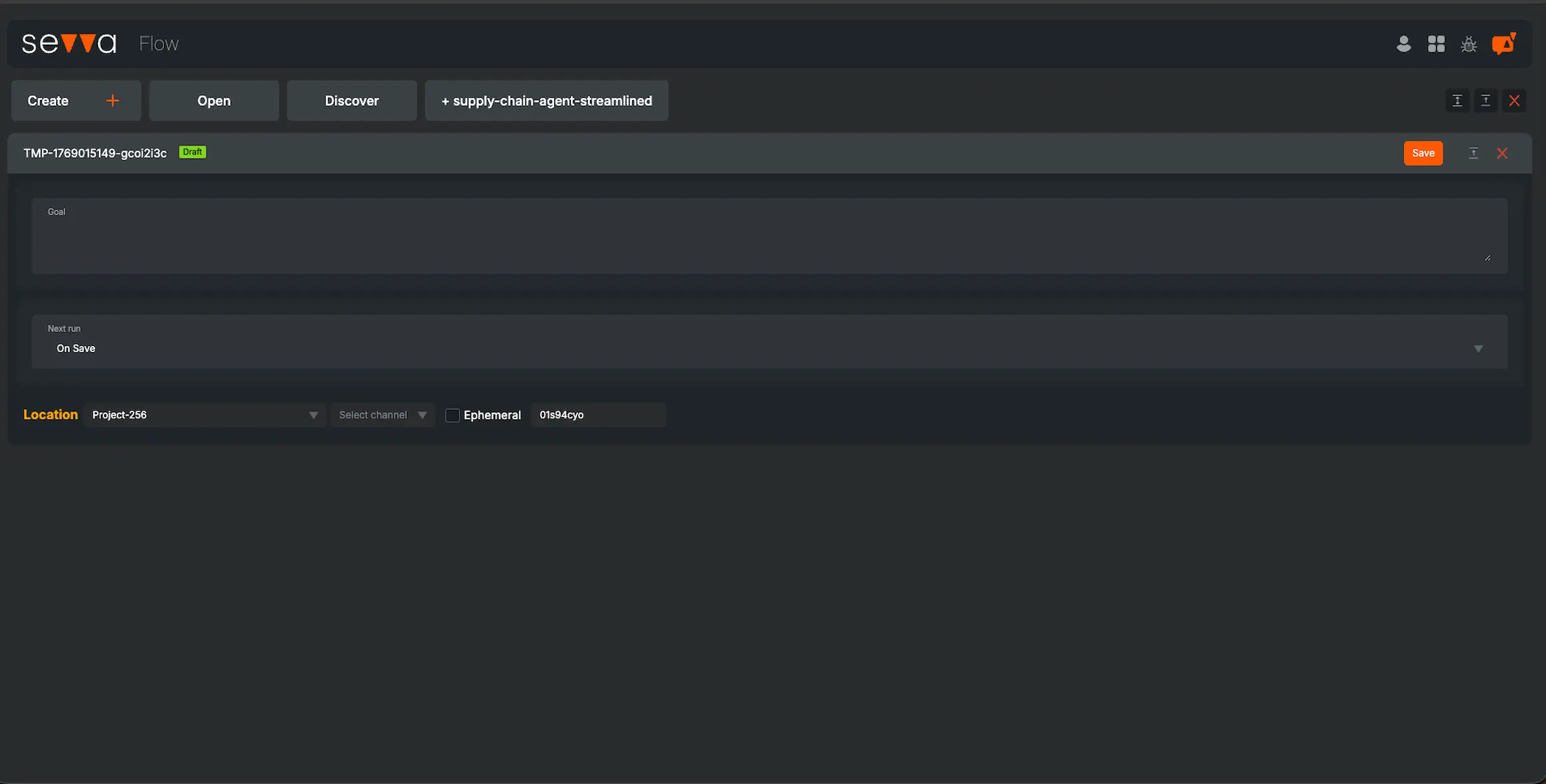

This dashboard contains a questions and answers section about Rosecliff Acquisition Corp I. The assessment of Rosecliff Acquisition Corp I is prepared by All Street Sevva using leading Cognitive Robots. Browse to the end of the page for potential risks for Rosecliff Acquisition Corp I based on industry, geography and marketcap.

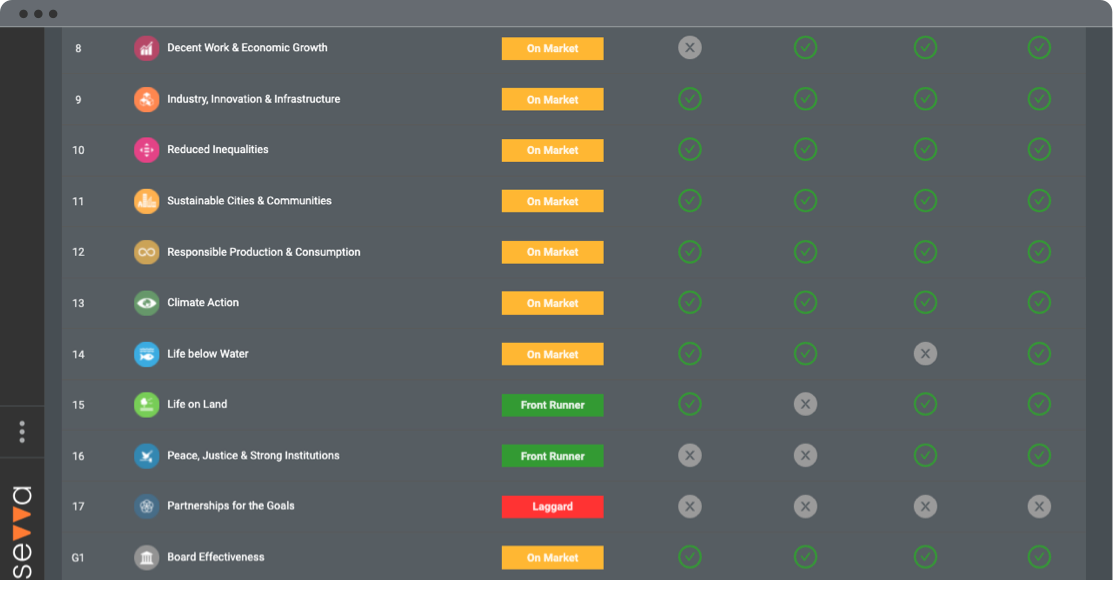

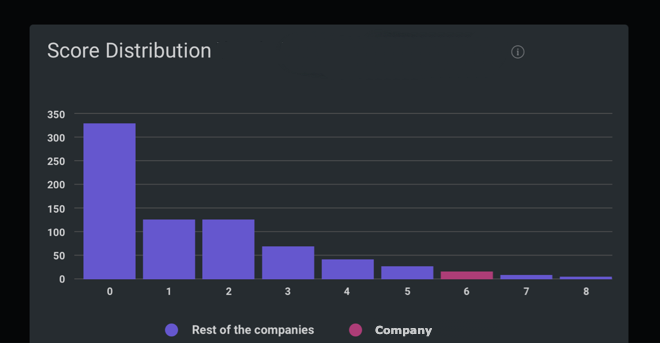

Rosecliff Acquisition Corp I in the Investment Holding Companies industry gained a UN SDG ESG Transparency Score of 2.7; made up of an environmental score of 2.7, social score of 0.0 and governance score of 5.3.

2.7

Low ImpactEnvironmental

Social

Governance

Peer Group Comparison

| Rank | Company | SDG Transparency Score ⓘ | Performance |

|---|---|---|---|

| 1 | CF Acquisition Corp VI | 8.0 | High |

| 1 | CHW Acquisition Corp | 8.0 | High |

| ... | ... | ... | |

| 238 | Senior Connect Acquisition Corp I | 3.1 | Medium |

| 238 | USHG Acquisition Corp | 3.1 | Medium |

| 255 | Rosecliff Acquisition Corp I | 2.7 | Medium |

| 255 | Pacific Century Group | 2.7 | Medium |

| 255 | CIIG Capital Partners II Inc | 2.7 | Medium |

| ... | ... | ... | |

| 550 | one | 0.0 | Low |

| 550 | theglobe.com Inc | 0.0 | Low |

| ... | ... | ... |

Frequently Asked Questions

Does Rosecliff Acquisition Corp I have an accelerator or VC vehicle to help deliver innovation?

Does Rosecliff Acquisition Corp I disclose current and historical energy intensity?

Does Rosecliff Acquisition Corp I report the average age of the workforce?

Does Rosecliff Acquisition Corp I reference operational or capital allocation in relation to climate change?

Does Rosecliff Acquisition Corp I disclose its ethnicity pay gap?

Does Rosecliff Acquisition Corp I disclose cybersecurity risks?

Does Rosecliff Acquisition Corp I use carbon offsets or credits exclusively for residual emissions (typically less than ~0.5–5% of total emissions)?

Does Rosecliff Acquisition Corp I offer flexible work?

Does Rosecliff Acquisition Corp I have a long term incentive (LTI) executive compensation plan based on a measure of return on capital?

Does Rosecliff Acquisition Corp I disclose the number of employees in R&D functions?

Does Rosecliff Acquisition Corp I plan to change its portfolio composition to lower the emissions intensity of its energy mix (e.g., by shifting from oil to gas, or by adding lower-carbon options like hydrogen, e-fuels, bioenergy, etc.)?

Does Rosecliff Acquisition Corp I conduct supply chain audits?

Does Rosecliff Acquisition Corp I disclose incidents of non-compliance in relation to the health and safety impacts of products and services?

Is there a statment that there is no plan to expand their cement production? (for example: 'We have no current plans to add additional cement making capacity')

Does Rosecliff Acquisition Corp I conduct 360 degree staff reviews?

Does Rosecliff Acquisition Corp I disclose the individual responsible for D&I?

Does Rosecliff Acquisition Corp I disclose current and historical air emissions?

Is there a statment that there is no plan to expand their coal usage? (for example: 'We have no current plans to add additional coal powered electricity generation')

Is executive remuneration linked to climate performance?

Does the Board describe its role in the oversight of climate-related risks and opportunities?

Does Rosecliff Acquisition Corp I disclose current and / or historical scope 2 emissions?

Does Rosecliff Acquisition Corp I disclose water use targets?

Does Rosecliff Acquisition Corp I have careers partnerships with academic institutions?

Did Rosecliff Acquisition Corp I have a product recall in the last two years?

Does Rosecliff Acquisition Corp I disclose incidents of discrimination?

Does Rosecliff Acquisition Corp I allow for Work Councils/Collective Agreements to be formed?

Has Rosecliff Acquisition Corp I issued a profit warning in the past 24 months?

Does Rosecliff Acquisition Corp I disclose parental leave metrics?

Does Rosecliff Acquisition Corp I disclose climate scenario or pathway analysis?

Does Rosecliff Acquisition Corp I disclose current and / or historical scope 1 emissions?

Does Rosecliff Acquisition Corp I explicitly state that carbon offsets or credits are separate from its emissions-reduction progress or that they are not counted toward its emissions-reduction targets?

Are Operating Expesnses linked to emissions reduction?

Does Rosecliff Acquisition Corp I disclose the pay ratio of women to men?

Does Rosecliff Acquisition Corp I support suppliers with sustainability related research and development?

Does Rosecliff Acquisition Corp I disclose the number of operations that have been subject to human rights reviews or human rights impact assessments?

Does Rosecliff Acquisition Corp I reflect climate-related risks in its financial statements?

Is there a statment that there is no plan to expand their carbon intensite energy assets? (for example: 'We have no current plans to carry out further drilling for oil,')

Is Rosecliff Acquisition Corp I involved in embryonic stem cell research?

Does Rosecliff Acquisition Corp I disclose GHG and Air Emissions intensity?

Does Rosecliff Acquisition Corp I disclose its waste policy?

Does Rosecliff Acquisition Corp I report according to TCFD requirements?

Does Rosecliff Acquisition Corp I plan to mitigate emissions from future new production assets through measures such as electrifying equipment, carbon capture and storage, repurposing waste gas, methane leak detection and repair, eliminating flaring, etc.?

Does Rosecliff Acquisition Corp I disclose its policies for bribery, corruption, whistle-blower, conflict of interest?

Does Rosecliff Acquisition Corp I disclose energy use targets?

Does Rosecliff Acquisition Corp I disclose its Renewable Energy targets?

Subscription required

Subscription requiredAre emissions metrics verified by STBi?

Subscription required

Subscription requiredDoes Rosecliff Acquisition Corp I have a policy relating to cyber security?

Have a different question?

Potential Risks for Rosecliff Acquisition Corp I

These potential risks are based on the size, segment and geographies of the company.

Rosecliff Acquisition Corp I, a blank check company, focuses on effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization/similar business combination with one or more businesses. The company was incoporated in 2020 and is based in New York, New York.